It’s considered that the longer the length of time you have a bad debt record, the harder it is to improve your credit. It can be quite problematic.

So, how long will it be before you aren’t liable for legal action? Especially as it will become harder and harder to get any credit in the future while this is in place.

Some credit companies may try to keep the report longer, but any debt on your record is legally able to remain for a period of six years. So, you need to workout what the companies are doing in order to be one step ahead of them…

Once the account has gone into into delinquency, a black mark will appear against your name and if you don’t make any payment arrangements, become bankrupt of have any other legal action happening, this debt will remain delinquent for up to six years.

This is where things can be complicated (court claim a debt explained further)

A creditor can refresh the debt on your report if they contact you near the end of the six years. i.e. if you have a debt on your record for five and a half years and there’s been no contact. They may only have to contact you for it to be refreshed.

The best way forward to consider, is to just not acknowledge the debt and decline any knowledge. Do not look into it or agree to it at all. Try to say that you have no idea of what they are referring to and simply put the phone down quite sharpish.

When you reach six years, you need to immediately contact the credit reporting agencies and ask to remove the debt from your credit report.

We offer Debt Consolidation Loans for homeowners.

Our team is on hand to help with number of questions you may have.

If you are struggling with debt, please visit Money Advice Service for help and advice.

We are a broker, not a lender.

Visitors also read:

Ways to Save – Should You Couple Up to Cut Back on Tax?

Ways to Save – Should You Couple Up to Cut Back on Tax?

Ways to Save – Should You Couple Up to Cut Back on Tax?

Making Money from Home

Making Money from Home

Making Money from Home

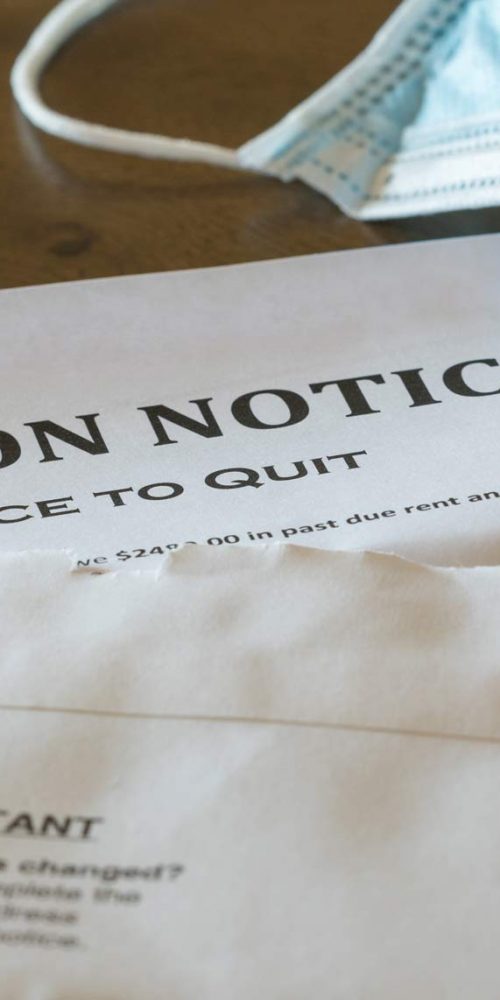

Evictions Postponed Until End of March but Cars Can Be Seized

Evictions Postponed Until End of March but Cars Can Be Seized

Evictions Postponed Until End of March but Cars Can Be Seized

Bank refused my loan application

Bank refused my loan application

Bank refused my loan application

Debt and coronavirus

Debt and coronavirus

Debt and coronavirus

Beating the Money Bullies

Beating the Money Bullies