Can I consolidate my medical loan?

Can I consolidation my medical loan? Debt Consolidation Loans cover a huge range of different debts and a wide variety of unique circumstances.

One area where they can prove particularly helpful is using debt consolidation loans for medical bills.

While most UK residents rely on the NHS for their medical treatment, not every procedure is covered. Dental work, cosmetic treatments and many more medical services can, unfortunately, require a loan to meet the costs.

Multiple treatments can quickly result in you being burdened with an unmanageable amount of debt. If your medical loans have started to get out of control, you might benefit from a medical consolidation loan.

What is a medical consolidation loan?

A medical consolidation loan works like any other debt consolidation loan, but it’s specifically aimed at consolidating medical expenses and bills into one easy to manage debt.

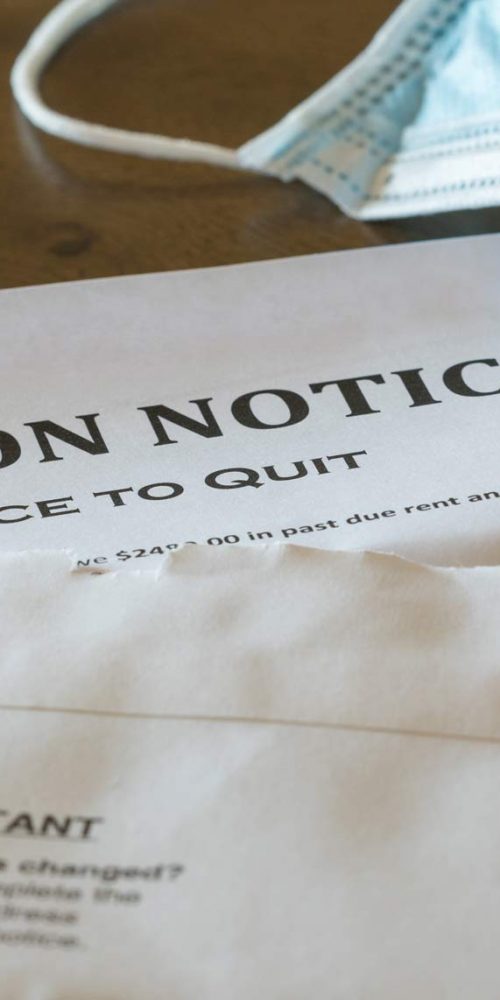

Given the current worldwide pandemic, people might find themselves accruing debts if they choose to take their health care private. In the UK, common cosmetic treatments and dental work can also be expensive, and many people take out loans to cover these.

Whatever your personal situation might be, if you’re struggling to pay multiple loans off at the same time, you can manage your debt with a medical consolidation loan.

What are the benefits of a medical consolidation loan?

For those in financial trouble, a medical consolidation loan can provide some financial stability.

With all your medical loans consolidated in one place, you’ll only have to worry about making a single monthly repayment, not multiple ones.

You’ll also be able to renegotiate your repayment terms and interest rates. Generally, that means you’ll end up saving money if you can secure lower interest rates for the consolidation loan.

We can help you to consolidate your loans

Here at Debt Consolidation Loans, we can help you to pay off your medical debts, so contact our debt consolidation experts today to find out more about the benefits of consolidating and how to get the process started.

We offer Debt Consolidation Loans for homeowners.

Our team is on hand to help with number of questions you may have.

If you are struggling with debt, please visit Money Advice Service for help and advice.

We are a broker, not a lender.

Visitors also read:

Evictions Postponed Until End of March but Cars Can Be Seized

Evictions Postponed Until End of March but Cars Can Be Seized

Evictions Postponed Until End of March but Cars Can Be Seized

What Debt Collectors Can and Cannot Do

What Debt Collectors Can and Cannot Do

What Debt Collectors Can and Cannot Do

Making Money from Home

Making Money from Home

Making Money from Home

The Role of the City Watchdog

The Role of the City Watchdog

The Role of the City Watchdog

New Bad Technology – Voice Hacking

New Bad Technology – Voice Hacking