Debt Consolidation Loan: Is It Suitable for You?

Debt Consolidation Loan: Is It Suitable for You?

Debt Consolidation Loan: Is It Suitable for You?

Coupon Code Offers: Unlock Your Savings Today

Coupon Code Offers: Unlock Your Savings Today

Coupon Code Offers: Unlock Your Savings Today

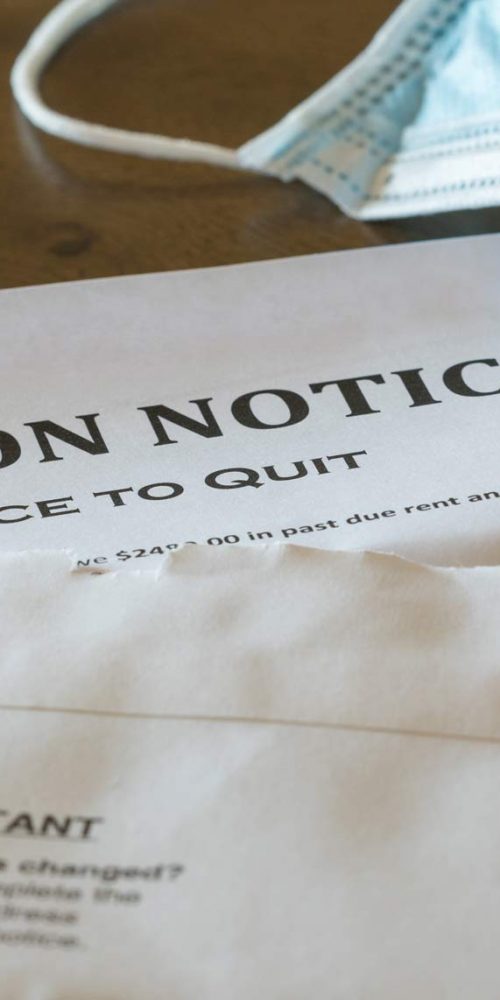

Evictions Delayed Until March, Car Seizures Still Allowed

Evictions Delayed Until March, Car Seizures Still Allowed

Evictions Delayed Until March, Car Seizures Still Allowed

Possible Double Dip Recession on the Horizon

Possible Double Dip Recession on the Horizon

Possible Double Dip Recession on the Horizon

Pensioners Targeted by Scammers: Stay Alert and Safe

Pensioners Targeted by Scammers: Stay Alert and Safe

Pensioners Targeted by Scammers: Stay Alert and Safe

Debt Consolidation Plan: Discover Emotional Benefits for Peace

Debt Consolidation Plan: Discover Emotional Benefits for Peace